Coming Soon

Coming Soon . . . Policy "PRE-approved"

We are working to provide our clients with the most seamless experience. For the insurance world, this means approvals of new policies and the magic words "Issued". While it may seem subjective to the experience of the client and preference for agent personality, selecting an insurance agent that can get you approved for a policy is vital to your success in getting quality coverage.

The potential risks of not selecting an agent adept at underwriting include:

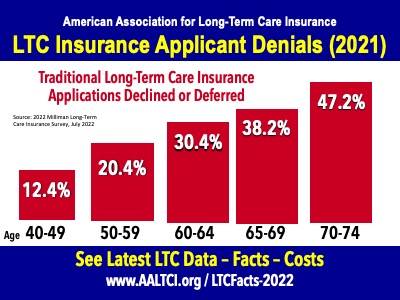

Getting declined

Becoming uninsurable

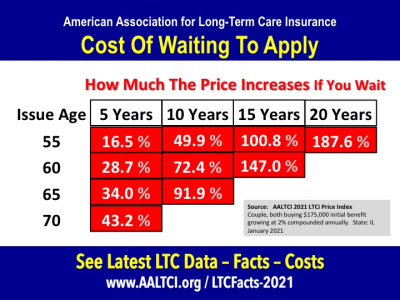

Paying significantly more for insurance

Being delayed months with additional exams and APS (attending physician's statement)

Something major happening in the intervening "pending" status and becoming less insurable

More ;)

That is why we are working on developing a tool that rates the likelihood that you will be approved for a policy, your ability to afford the policy, and estimating the amount of coverage appropriate to your situation.

If you can come to an agent and tell them which pre-existing health issues you know will make or break it, you will save time, money, and enjoy a much more positive customer experience. All PIH and other data will be protected in this process as it will be entirely anonymous.

Below are some statistics on the impact of poor underwriting decisions, including a "Denied" applications.

You can tell us "thank you" later! Have a great day.